Ready, Set, Get Pre-Approved!

Discover your loan options without impacting your credit score.§

Personal Loans Designed for Your Needs

Apply in minutes for a Cash Money loan and be offered our best loan options for your financial situation.

Line of Credit

Most Popular

- checkmark

Up to $10,000

- checkmark

Borrow what you need, pay only for what you use

- checkmark

Apply once and access available credit anytime, anywhere

- checkmark

Get pre-approved with no impact to your credit score§

Auto Equity Loan

- checkmark

Up to $10,000

- checkmark

Secure your loan with your vehicle

- checkmark

May qualify for more than a Line of Credit

- checkmark

Help build your credit†

- checkmark

Get pre-approved in a branch with no impact to your credit score§

Payday Loan

- checkmark

Up to $1,500

- checkmark

Get funding in as little as 15 minutes

- checkmark

Flat fee based on amount borrowed

- checkmark

Get pre-approved with no impact to your credit score§

How to Apply for Your Loan

We will walk you through our simple loan process. (Swipe Below)

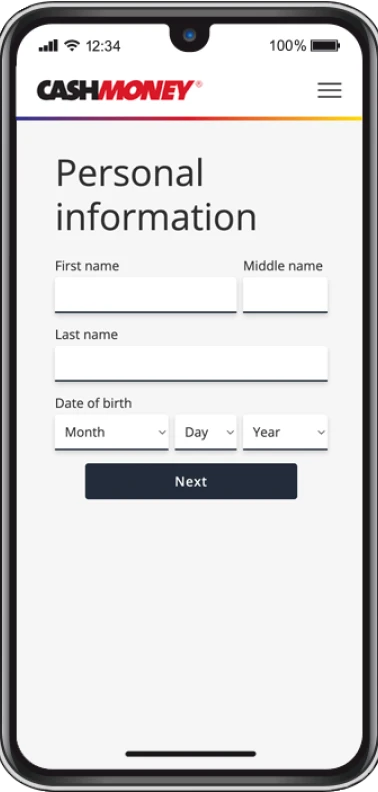

Step 1: Apply

Step 2: Verification,

Loan Decision, Review & Sign

Step 3:

Get Your Funds

Provide required documentation:

- Age 18 or older

- Valid ID

- Steady source of income

- Open chequing account

- Phone number

- El and disability are accepted

Receive a fast lending decision and review documents. Once approved, sign your loan agreement.

- Online

- By Phone

- In a Branch for Auto Equity Loan

Why Choose Cash Money for Your Loan?

Because we make the loan process accessible with quality support.

Loyalty

The Cash Money Line of Credit, Payday Loan, and Auto Equity Loan products can help with your long-term and short-term lending needs. Whether you have a surprise expense, a special purchase, or are short on funds, we’re your choice for personal loans.

32

Years in Service

19 Million+

Customer Loans since 2000

Locations

For an in-person loan journey, conveniently visit us at one of our branches. Our Cash Money representatives are happy to help you one-on-one throughout the loan process.

150+

Branches

Customer Service

Every Customer experience is important. Our representatives are professional, friendly, and well-educated so they can find the best solution for you.

3 Million+

Canadian Customers since 2005

Why Apply for a Cash Money Quick Loan?

When you need funds to bridge a financial gap, we make it simple to get your money fast.

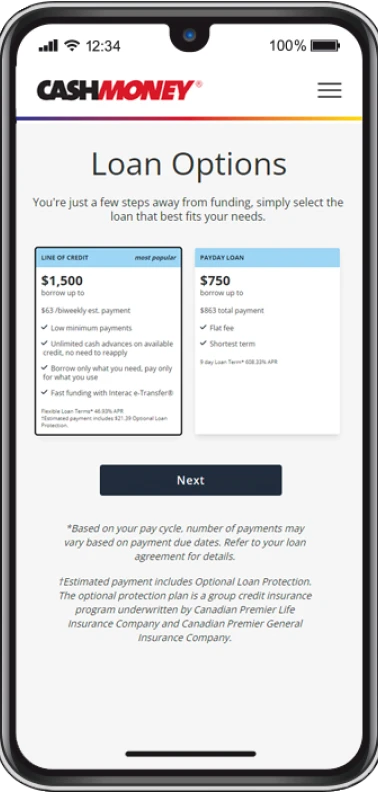

Line of Credit

Our Most Popular Product.

Continuous borrowing flexibility.

You choose how much to borrow, then only pay on what you use.

With a higher credit limit than a Payday Loan and the benefit of using it when you need it, our Line of Credit is a top choice among our Customers.

Auto Equity Loan

Would benefit from a secured loan.

Could be approved for more money than an unsecured loan.

Keep your vehicle and ownership documentation.

You could build your credit†.

Payday Loan

Need funds fast!

Only need a smaller loan for a shorter time.

Don’t need collateral or great credit as the ability to repay is most important.

Easily apply online, quickly and conveniently.

Apply from Anywhere

Online, by phone, or in a branch, conveniently start your application process with a few verifiable documents. Then, get a loan decision within minutes.

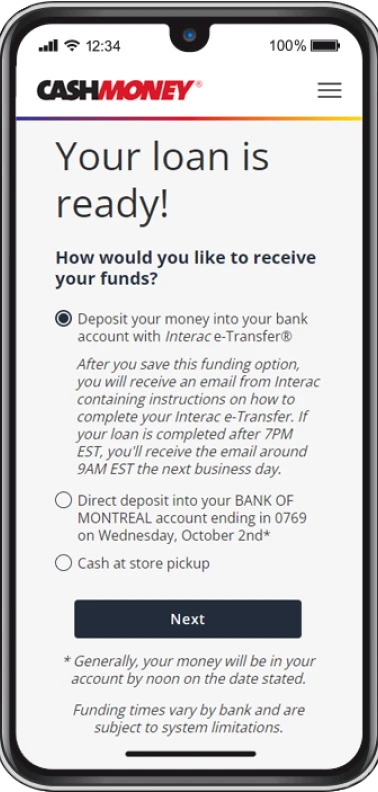

Fast Funding

Get your money in as little as 15 minutes with Interac e-Transfer® or through direct deposit to your bank account.

Satisfied Customers

Frequently Asked Questions

Want more answers? Check out our FAQs page.

You can see all the online loan options in your province and how much you are pre-approved for with no impact to your score. If you choose to accept a Line of Credit then a hard inquiry will occur which may impact your credit score.§ To get pre-approved for an Auto Equity Loan you will need to visit your local branch.

With a Line of Credit, you’re in control of how you borrow. If approved, you can use the full credit limit amount at one time or borrow what you need as you need it. You only pay interest on the amount you borrow. As you make payments, more of your credit limit becomes available.

- 1. Complete an application online, over the phone or at a branch

- 2. Verify your income

- 3. Receive a lending decision

- 4. Get your money

- 5. Make scheduled loan payments (make additional payments to save on interest)

- 6. Access available credit by getting additional cash advances (up to your credit limit)

Simply apply online, by phone, or at a branch location. You will need the following to qualify:

- Age 18 or older

- Valid ID

- Steady source of income

- Open chequing account

- Phone number

Currently, we only report Auto Equity Loan information to the credit reporting agency. This includes, but is not limited to:

- Type of loan

- Original loan amount

- Date loan was opened

- Date loan was closed (if applicable)

- Date of last payment

- If payment was received on time or late/missed

- Balances